Image Source: Amazon.com

An Overview

In

business, a trading day or regular trading hours (RTH) is the period of time

that an exchange is open, as opposed to electronic or extended trading

hours (ETH). Trading days are

generally Monday to Friday. At the end of a trading day, all transactions end

and are frozen until the start of the

next trading day.

The

knowledge of trading days in a year allows investors and traders to plan strategies, plan transactions and make

informed decisions. From the stock market to the futures market, including the

forex and cryptocurrency markets, each

segment operates on its own trading schedule.

Main Insights:

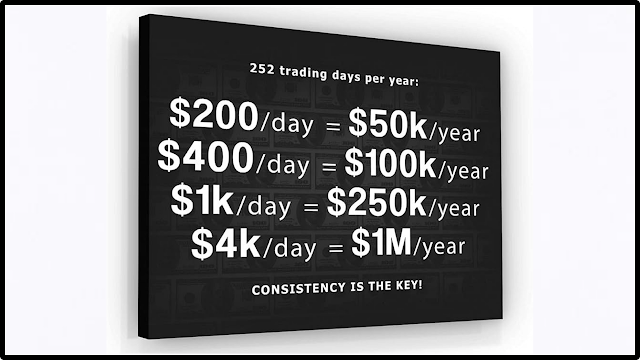

The NYSE and NASDAQ stock exchanges average

approximately 252 trading days per year. This corresponds to 365.25 (average

days per year) * 5/7 (proportion of working days per week) – 6 (weekdays

holidays) – 4*5/7 (fixed holidays) = 252.03 ≈ 252.

Calculation-The Trading Days Formula

To

calculate trading days, subtract weekends and holidays from the total number of

days in a year, which is typically 365. In the period from 1990 to 2022, the average annual number

of stock market trading days was always around 252.

However, there were slight fluctuations, taking into account the period from 1990 to 2021, the average was 252,875. It should be noted that while this number is generally stable at 252, it can fluctuate slightly.A closer look at the computer components reveals these nuances.

Stock

Market Non-Operational-Holidays

There

are nine holidays that the New York Stock Exchange (NYSE) observes each year,

and they are as follows:

● New Year’s Day (January 1st)

● Martin Luther King, Jr Day (The

third Monday of January)

● Presidents’ Day (The third Monday in

February)

● Good Friday (The Friday before

Easter Sunday)

● Memorial Day (last Monday of May)

● Independence Day (July 4th)

● Labor Day (The first Monday in

September)

● Thanksgiving Day (The fourth

Thursday of November)

● Christmas Day (December 25th)

Some

public holidays coincide with weekends (Saturdays and Sundays). Specific rules

apply to market holidays in such cases. There are actually 2 rules:

● If the public holiday falls on a

Saturday, the stock market is closed on

the previous Friday.

● The markets remain closed on the

following Monday, as a public holiday comes on a Sunday.

On

or near certain holidays, stock markets

remain open while bond markets remain closed or close early. The NYSE and

NASDAQ will follow the federal government's holiday closure plan, except for

Veterans Day (open), Columbus Day (open), and Good Friday (closed).

Trading Styles Impact on Trading Days

The

number of trading days a trader uses can

vary depending on his or her trading style. For example, day traders trade

every day, unlike swing traders and position traders. Factors such as holidays,

family events, illnesses or meetings can also make participating in trading

difficult for traders of all styles.

Swing Trading:

Swing

trading is a trading strategy that uses both fundamental and technical analysis

to profit from large price movements and avoid periods of inactivity. Swing

trading generally involves holding a

long or short position for more than one trading session, but no longer

than a few weeks or months. While swing trading gives investors the opportunity

to profit from short-term price movements, it also carries the risk that if the

market moves in the opposite direction to the investor’s position that they

will lose potential returns.

Position trading:

Position

trading is a trading strategy where traders hold their positions for long

periods, usually weeks to months, to see and listen to trends to make a profit

although position trading allows traders to exploit them over long periods of

growth in the market, which can be more profitable than short-term.

Market Volatility-Trading Days

Image Source: Medium

Market

volatility is known that some trading days, such as the first and last day of

the month or the days before and after public holidays, are more volatile,

which may affect trading success on

these days.

Riskiest

Time Frames For Trading-Hours

Even

though a normal trading day lasts six and a half hours, they are not that

volatile and risky. During the first and last hour of each trading day you will

observe high trading volume and prices

fluctuate up and down every second. In the morning, many people trade stocks

that are in the news: earnings reports, major events, etc. In the last hour,

volume and volatility have increased again as traders try to close remaining positions. For day traders, these

are the two most important moments of

the day. Outside the first and last hours the market is much more stable unless

there is important news.

Riskiest

Time Frames For Trading-Days

It

is also worth noting that some trading

days are riskier than others due to

various factors.

● First and last days within each

month.

● The first Friday of each month when the stock

report is released

● The days when the results of the largest companies are published are announced every day by the Fed – or the Federal Open Market Committee (FOMC), as they are officially known.

Best

Months For trading

Now

that you know how to trade based on the day of the month or week you're in,

it's time to look at how to trade on some "special" months.

January

Effect:

Many

believe this is because investors are

returning to work after the holidays with a positive attitude and

looking for new opportunities.

The

September Effect:

September

is considered a good month to sell by

many traders for many reasons. First, this is the worst performing month for

the three major US indices.Additionally, many individual traders close their

positions to offset learning costs. Finally, a lot of what could happen in

October.

October

- The Month With The Highest Volatility:

There

is no exact reason why October stands out, but some experts believe it is due

to the stock market crashes of 1929 and

1987, which occurred this month. For this reason, many investors are afraid of this month. Historically, however, October

was a positive month, even if the gains were rather limited.

Christmas

Eve discount :

In

the last days of the year, many traders

are closing their positions. So now is a good time to buy stocks if you want to

buy them at a discount and also take advantage of the big purchases in early January.

Trading

Days in Years: 2023-2024-2025

The

number of trading days for the next 3 years is approximately the same.

➔ There will be a total of 252 trading days in

2023.

➔ In 2024 the stock market calendar will have

251 days.

➔ In 2025, the total wide variety of days on

which stocks may be traded is 250.

However,

there may be exceptions for weekends or

other special circumstances that may affect the number of trading days, such as

unscheduled market closures due to natural disasters, terrorist attacks or

other events.

Frequently

Asked Questions:

➢ Are trading days business days?

Trading

days are business days.Trading days mark the time when stock exchanges and other financial markets

are open and stocks and commodities are actively traded for companies and

investors.

➢ Define power hour when discussing

the stock market?

The

stock market hour refers to the first and last hours of the trading day, which

are known for increased activity as traders actively enter or exit positions.

This intensity is particularly visible on Fridays and Mondays, which are

considered the most active days of the week and where investors, institutions

and retailers strategically conduct trading activities.

Is

it possible for day traders to execute trades outside of regular trading hours?

Yes,

day traders can trade outside of business hours with the two-hour trading plan.

This approach allows them to benefit from market open and close volatility without being subject to the Pattern Day

Trader (PDT) rule. This flexibility in trading hours gives day traders with

small account sizes the opportunity to explore additional opportunities and

benefit from after-hours market movements.